Blog/What are these cartoon monkey NFTs and why do people pay so much for them?

25th November 2022

I’m not going to lie – I’m slightly baffled by, and wholly skeptical of, the whole NFT thing, so I imagine there’s a decent chance that you are too. That being the case, I’ve done a bit of research, and I’m going to share my findings with you now. Buckle up – I’m a complete noob, so it could be a bumpy ride!

First things first. NFT stands for ‘Non-fungible token’, with ‘fungible’ meaning (according to Google) ‘the ability of a good or asset to be interchanged with other individual goods or assets of the same type’. So, non-fungible essentially means ‘unique’.

A ‘token’, in this case, is a digital asset that can be traded on something called ‘Blockchain’ – a network that records ownership of business assets.

So an NFT, if I’ve understood correctly, is the record of ownership of a unique, collectable, digital asset (not the digital asset itself – very important difference!) that can be traded, or bought via Blockchain.

So far so good!

This digital asset can be a piece of digital art, or a photograph, or an avatar, or a piece of music, that typically can be replicated, but that are associated with a single NFT that denotes ownership of said digital asset (think of it like deeds to a house), and that can come with a range of benefits to its owner – access to events, competitions, prizes etc & the like – from its creator as an incentive to buy it.

The first known NFT appeared in 2014, and featured a short home-movie clip, registered on the Namecoin blockchain and was sold for a $4. Fast forward seven years and a digital collage by artist Beeple entitled ‘the first 5000 days’ sold by Christie’s auction house for – wait for it – an eye-watering $69.3m!!

So why are/were people prepared to pay so much for NFTs?

Well, it would seem that as a ‘speculative asset’ – ie, one that the buyer anticipates will, over time, increase in value, when it can be sold on for a profit – NFTs enjoyed an economic bubble similar to the dot-com boom that coincided with the advent of the internet.

And so, for a brief time in 2020/2021 their value skyrocketed, propped up by media and celebrity interest, ambitious financial valuations, and a lack of regulation leading to investment as a means of money laundering.

Everyone from film directors to sports teams, music artists and multinational brands released their own NFTs as a way of generating funds, with varying degrees of success.

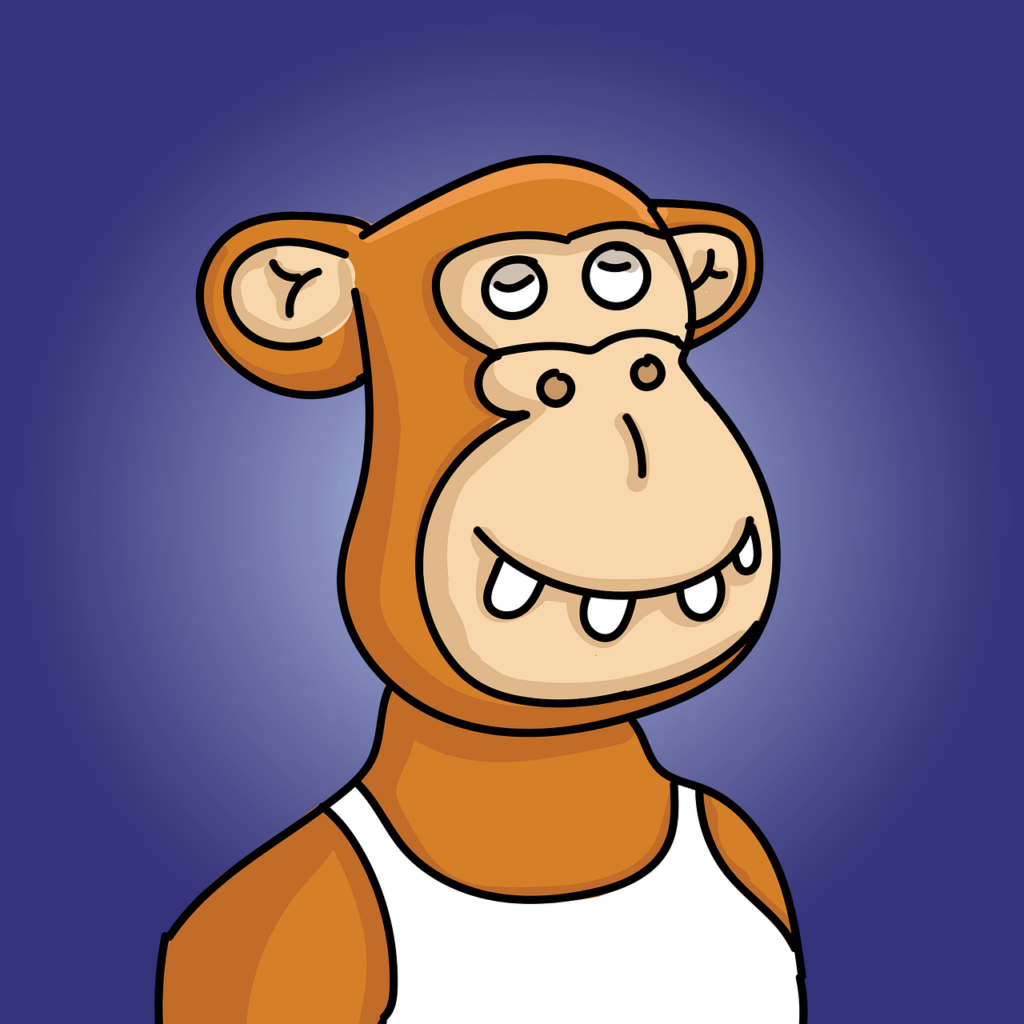

One of the more recognisable series of NFT/digital assets is the Bored Ape Yacht Club cartoon ape avatars – a series of 10,000 pretty crudely drawn monkeys wearing Hawaiian shirts and smoking cigarettes and snarling – you get the idea – that people went mad for.

They began at $190, and steadily increased in value until Eminem reportedly paid almost half a million dollars for his some time later – which again pushed up their value.

1 year after it was founded, BAYC – creators of the bored ape series of avatars – was valued at $4bn.

However, like all bubbles, a pop is inevitable. An NFT of the first ever Tweet that sold in 2021 for $2.9m was put up for sale a year later valued at $48m, but realised a top bid of just $280.

And like all speculative assets, once the confidence goes, so does the value, and a crash shortly follows.

Justin Bieber reportedly lost $1.25m on the BAYC NFT he bought for $1.3m in 2021, and so it would seem the bottom has well and truly fallen out of the NFT game.

Bill Gates once described the NFT market as “100% based on the ‘Greater fool theory'”, whereby someone can always make money providing there’s a greater fool than them to buy whatever it is that they were foolish enough to invest in.

Perhaps we’ve run out of fools, and the – almost inexplicable – desire to pay bucketloads of money for a rubbish drawing of a monkey, or a photo of a guitar has gone for good!

Maddison Creative is a web design studio in Newcastle upon Tyne.